Section 240.14a‑12

| þ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

2016

PROXY STATEMENT AND NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS

April 1, 2016

Dear Fellow Stockholders:

| Dear Fellow Stockholders, | August 24, 2020 |

Overviewa conversion price of $1.35 per share, subject, however, to the condition that the average of the 2015 Economic Environment in Our Industry:

The level of demanddaily trading prices for our products and servicesCommon Stock over the preceding 20‑trading day period is directly relatedat least $1.50 per share. The conversion price of $1.35 per share represents a premium of 178.4% to drilling and completion activity levels and the closing price on July 2, 2020, the last trading day prior to commencement of the Exchange Offer. The Exchange Offer was made in connection with our ongoing efforts to improve our capital and operating budgetsstructure by extending the upcoming maturities of our customers, which in turndebt securities and creates alignment between the long term interests of both our stockholders and noteholders. Under the terms of the New Notes, we are influenced heavilyrequired to obtain the stockholder approval required by energy prices and the expectation as to future trends in those prices. The precipitous decline in oil and natural gas prices sincerules of the middle of 2014 has resulted in a significant decrease in exploration and production activity, and spending by our customers. Despite these significant challenges, 2015 was a successful yearNew York Stock Exchange for Forum and highlighted below are somethe issuance of our most noteworthy achievements.Common Stock upon conversion of the New Notes by June 30, 2021.

Strong Performance:

To protect the core of our business, we took decisive stepsemployees, I would like to reduce costs in line with declining activity levels, including capital expenditure reductions and implementing company-wide cost reduction measures. In spite of declining activity, we achieved strong free cash flow and as of December 31, 2015 we paid off the revolving portion of our bank credit facility. Most importantly, safety has remained a top priority for Forum as demonstrated by the exceptional performance in this regard on a year over year basis.

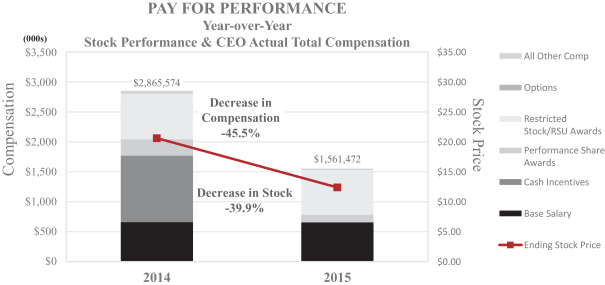

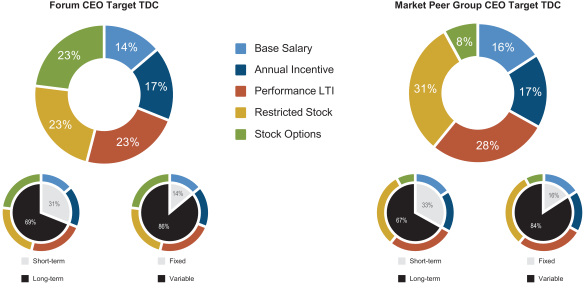

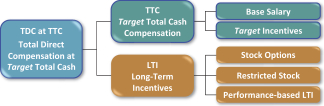

Alignment of Compensation and Performance:

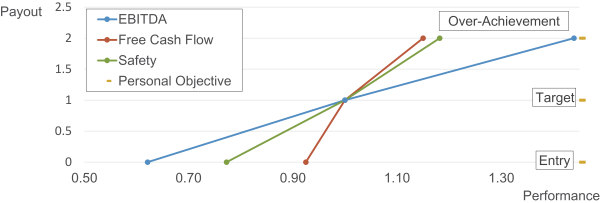

Our compensation program appropriately rewards executives for producing sustainable growth consistent with our long-term goals. We are striving to continuously enhance the link between pay and long-term performance, and align our executive compensation program with long-term shareholder interests. In 2015, greater than 75% of total target executive compensation was at-risk and tied to the Company’s performance.

Looking Forward:

Similar to 2015, this year is continuing to present significant challenges for the industry. It has been our strategy to be an early-cycle, activity-driven, and scalable company with a strong balance sheet and low capital intensity. We believe Forum’s performance reflects our successful execution of that strategy and are confident that the actions we are taking will position the Company to capitalize on an increase in drilling and completion activity. In particular, we believe our product development, the streamlining of our operations to provide operational efficiency and market share growth during these challenging times will pay dividends in the long-term. I am proud of all that we have achieved in Forum’s relatively short-time as a public company, and of the strong culture we are building. Thank youexpress my appreciation for your continued support of and interest in Forum Energy Technologies.

engagement with Forum.

FORUM ENERGY TECHNOLOGIES, INC.

To Be Held on May 17, 2016

The annual meeting

| 1. | to approve, for purposes of the rules of the New York Stock Exchange, the issuance of up to 145,052,272 shares of our common stock upon conversion of a portion of our newly issued 9.00% Convertible Senior Secured Notes due 2025 (the “New Notes” and such purpose, the “Proposal”); and |

| ||||

|

| |||

|

| |||

|

| |||

|

|

Attached to this notice is a proxy statement setting forth information with respect to

The boardclose of directors has established Marchbusiness on August 21, 2016 as the record date for the determination of stockholders2020 will be entitled to notice of, and to vote at, the annualSpecial Meeting, or any adjournment or postponement thereof, notwithstanding the transfer of any shares after such date. For specific voting information, see “General Information” beginning on page 1 of the enclosed Proxy Statement.

We are utilizing the Securities and Exchange Commission rules that allow issuers to furnish proxy materials to their stockholders over the Internet. We believe these rules allow us to provide our stockholders with the information they need, while lowering the costs of delivery. On or about the date hereof, we are mailing to our stockholders ameeting.

By Order of the Board of Directors,  |

| John C. Ivascu |

| Executive Vice President, General Counsel, Chief Compliance Officer and Corporate Secretary |

|

|

|

|

April 1, 2016

920 Memorial City Way,

300

IMPORTANT INFORMATION REGARDING THE ANNUAL MEETING OF STOCKHOLDERS

Registration will begin at 7:30 a.m. Please note that space limitations make it necessary to limit attendance at the meeting to stockholders, though each stockholder may be accompanied by one guest. Please bring photo identification, such as a driver’s license or passport, and if you hold your shares in brokerage accounts, a copy of a brokerage statement reflecting stock ownership as of the record date. Please keep in mind that cameras, recording devices and other electronic devices are not permitted at the meeting.

77064

i

920 Memorial City Way,

300

77064

FOR

2016 ANNUAL

We have elected to provide access to our proxy materials over the Internet and are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders of record. All stockholders will have the ability to access the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found on the Notice.

All properly executed written proxies delivered pursuant to this solicitation, and not later revoked, will be voted at the annual meeting in accordance with the instructions given in the proxy. When voting regarding the election of directors, stockholders may vote in favor of all nominees, withhold their votes as to all nominees or withhold their votes as to specific nominees. When voting regarding the approval of the compensation of our named executive officers, the approval of the 2016 Stock and Incentive Plan and the ratification of the appointment of our independent registered public accounting firm, stockholders may vote for or against the proposal or may abstain from voting. Stockholders should vote their shares on the proxy card we have provided. If no choice is indicated, proxies that are signed and returned will be voted as recommended by our board of directors.

Allrecord date, there were 111,342,008 shares of our common stock represented by properly executedCommon Stock outstanding and unrevoked proxies will be voted if such proxies are received in time for the meeting.

QUORUM, VOTE REQUIRED AND REVOCATION OF PROXIES

The board of directors has established March 21, 2016 as the record date for the determination of stockholders entitled to notice of and to vote at the annual meeting.Special Meeting, which were held by approximately 39 holders of record.

| Q. | Why am I receiving these proxy materials? |

| A. | You are receiving this Proxy Statement and a proxy card from the Company because, on August 21, 2020, the record date for the Special Meeting, you owned shares of the Company’s Common Stock. This Proxy Statement describes the matters that will be presented for consideration by the Company’s stockholders at the Special Meeting. It also gives you information concerning the matters to assist you in making an informed decision. As discussed in greater detail above, we are calling a Special Meeting of our stockholders to approve the issuance of Common Stock upon conversion of the New Notes, which are convertible into our Common Stock on a pro rata basis at a conversion price of $1.35 per share, subject, however, to the condition that the average of the daily trading prices for our Common Stock over the preceding 20-trading day period is at least $1.50 per share. The conversion price of $1.35 per share represents a premium of 178.4% to the closing price on July 2, 2020, the last trading day prior to commencement of the Exchange Offer. |

| Q. | What am I voting on? |

| A. | Holders of our Common Stock are being asked to approve, for purposes of the rules of the New York Stock Exchange (“NYSE”), the issuance of up to 145,052,272 shares of our Common Stock upon conversion of a portion of the New Notes. |

| Q. | When and where is the Special Meeting? |

| A. | The Special Meeting will be a completely virtual meeting of stockholders, which will be conducted via live webcast on September 15, 2020 at 8:00 a.m., Central Daylight Time. There will not be a physical location for the Special Meeting. |

| Q. | Why a virtual meeting? |

| A. | Due to health and safety concerns related to the coronavirus (COVID‑19) outbreak, recommendations and orders from various federal, state and local governmental authorities, and out of an abundance of caution to support the health and well‑being of our stockholders, employees and community, we are offering our stockholders a completely virtual Special Meeting. We are committed to ensuring that stockholders will be afforded the same rights and opportunities to participate as they would at an in‑person meeting. |

| Q. | Who is entitled to vote? |

| A. | Holders of record of our Common Stock at the close of business on August 21, 2020, will be entitled to notice of and vote at the Special Meeting. |

| Q. | Who is soliciting my vote pursuant to this Proxy Statement? |

| A. | Our Board is soliciting your vote at the Special Meeting. In addition, certain of our officers and employees may solicit, or be deemed to be soliciting, your vote. We will bear the expense of preparing, printing and mailing this |

| Q. | How many shares are eligible to be voted? |

| A. | As of the record date of August 21, 2020, we had 111,342,008 shares of Common Stock outstanding. Each outstanding share of our Common Stock will entitle its holder to one vote on each matter to be voted on at the Special Meeting. For information regarding security ownership by the beneficial owners of more than 5% of our Common Stock and by our directors and management, see “Security Ownership.” |

| Q. | How do I vote my shares? |

| A. | You may vote your shares either virtually or by proxy. To vote by proxy, you may vote via telephone by using the toll‑free number listed on the proxy card, via Internet at the website for Internet voting listed on the proxy card, or you may mark, date, sign and mail the enclosed proxy card in the enclosed envelope. Giving a proxy will not affect the right to vote your shares if you attend the Special Meeting and want to vote virtually - by voting virtually you automatically revoke the proxy. If you vote the shares virtually, you will need the control number included on your notice, on your proxy card or on the instructions that accompanied your proxy materials to prove that you own the shares as of the record date. You also may revoke the proxy at any time before the meeting by giving the Corporate Secretary of the Company written notice of the revocation or by submitting a later dated proxy. If you return the signed proxy card but do not mark your voting preference, the individuals named as proxies will vote the shares in accordance with the recommendations of the Board as set forth below. |

| Q. | What are my voting choices? |

| A. | You may vote “FOR” or “AGAINST” or you may “ABSTAIN” from voting on any proposal to be voted on at the Special Meeting. Your shares will be voted as you specifically instruct. If you sign your proxy or voting instruction card without giving specific instructions, your shares will be voted in accordance with the recommendations of our Board and in the discretion of the proxy holders on any other matters that properly come before the meeting. |

| Q. | What are the recommendations of the Board? |

| A. | The Board unanimously recommends that you vote “FOR” the approval of the Proposal. |

| Q. | Can I change or revoke my vote? |

| A. | Yes. Even if you submitted a proxy by telephone or via the Internet or if you signed the proxy card accompanying this Proxy Statement, you retain the power to revoke your proxy and to change your vote. You can revoke your proxy any time before it is exercised by giving written notice to the Corporate Secretary specifying such revocation. You may also revoke your proxy by a later‑dated proxy by telephone or via the Internet or by timely delivery of a valid, later‑dated proxy by mail or by voting by ballot at the Special Meeting. Your attendance at the Special Meeting in itself will not automatically revoke a previously submitted proxy. If you hold your shares through a broker, bank or nominee and have instructed your broker, bank or nominee how to vote your shares, you must follow directions received from the broker, bank or nominee in order to change your vote or to vote at the Special Meeting. |

| Q. | What vote is required to hold the Special Meeting? |

Special Meeting on the record date. The three nominees for director who receive the greatest number of votes cast at the meeting will be elected as directors. If any nominee for director receives a greater number of votes “withheld” than votes “for” such election, our Board requires that such person must tender his or her resignation if he or she fails to receive the required number of votes for re-election. Cumulative voting is not permitted in the election of directors. The approvalpresence of the compensationholders of our named executive officers on an advisory basis and the ratification of the appointment of our independent registered public accounting firm is subject to the approval ofat least a majority of the outstanding shares of common stockCommon Stock is required to establish a quorum for the Special Meeting. Proxies that are voted “FOR,” “AGAINST” or “ABSTAIN” with respect to a matter are treated as being present in person or by proxy at the meetingSpecial Meeting for purposes of establishing a quorum and also treated as shares “represented and voting” at the Special Meeting with respect to such matter. All votes will be tabulated by the inspector of elections appointed for the Special Meeting who will separately tabulate, for each Proposal, affirmative and negative votes, and abstentions.

| Q. | What is a broker non‑vote? |

| A. | Brokers are permitted to vote on discretionary items if they have not received instructions from the beneficial owners, but they are not permitted to vote (a “broker non‑vote”) on non‑discretionary items absent instructions from the beneficial owner. With respect to the Special Meeting, brokers are prohibited from exercising discretionary authority with respect to the approval of the Proposal. Therefore, if you hold your shares in “street name,” you must instruct your broker how to vote for the Proposal in order for your shares to be voted at the Special Meeting. |

| Q. | How many votes are needed to approve the Proposal? |

| A. | The approval of the Proposal requires the affirmative vote of a majority of the outstanding shares of Common Stock present and entitled to vote on this Proposal. Abstentions will have the same effect as a vote against the Proposal. |

| Q. | What do I need to do now? |

| A. | We urge you to read this Proxy Statement carefully and to vote your shares "FOR" the Proposal. Then, mail your completed, dated and signed proxy card in the enclosed return envelope as soon as possible so that your shares can be voted at the Special Meeting. Holders of record may also vote by telephone by calling toll-free 1-800-PROXIES or 1-800-776-9437 in the United States or 1-718-921-8500 from foreign countries using a touch‑tone phone, or via the Internet by visiting www.voteproxy.com and following the on‑screen instructions or by scanning the QR code with a smartphone, or they may vote virtually at the Special Meeting. Holders of record should have their proxy card available when voting by telephone, Internet or virtually at the Special Meeting. |

| Q. | What happens if I do not respond or if I respond and fail to indicate my voting preference or if I abstain from voting? |

| A. | If you fail to sign, date and return your proxy card or fail to vote by telephone or via the Internet as provided on your proxy card, your shares will not be counted towards establishing a quorum for the Special Meeting, which requires holders representing a majority of the outstanding shares of our Common Stock to be present virtually or by proxy. |

Brokers holding shares of our common stock must vote according to specific instructions they receive from the beneficial owners of those shares. If brokers do not receive specific instructions, brokers may in some cases

vote the shares in their discretion. The New York Stock Exchange, however, precludes brokers from exercising voting discretion on certain proposals without specific instructions from the beneficial owner. Under NYSE rules, brokers holding shares in “street name” for their beneficial holder clients will have discretion to vote only on the ratification of the appointment of our independent registered public accounting firm. Brokers cannot vote on the other matters to be considered at the meeting without instructions from the beneficial owners. If you do not instruct your broker how to vote on those matters, your broker will not vote on your behalf.

Abstentions and broker non-votes are counted as present in determining whether the quorum requirement is satisfied. For purposes of determining the outcome of any question as to which the broker has indicated that it does not have discretionary authority to vote, these shares will be treated as not present with respect to that question, even though those shares are considered present for quorum purposes and may be entitled to vote on other questions. Because the three nominees for director who receive the greatest number of votes cast at the meeting will be elected as directors, abstentions and broker non-votes will not affect the outcome of the voting on the elections. Because the approval of the compensation of our named executive officers on an advisory basis, the approval of our 2016 Stock and Incentive Plan, and the ratification of the appointment of our independent registered public accounting firm requires the approval of a majority of the shares of common stock present in person or by proxy at the meeting and entitled to vote on the matter, abstentionsProposal. Abstentions will have the same effect as votesa vote against these proposals. Broker non-votes, on the other hand, will not affect the outcomeProposal.

| Q. | What will happen if the Proposal is not approved? |

| A. | If the Proposal is not approved and we are unable to obtain stockholder approval for the Proposal by June 30, 2021, the New Notes will become immediately due and payable and we would likely need to seek relief under the U.S. Bankruptcy Code, in which case there could be no assurance that our stockholders would retain all or any of their equity ownership in the Company. |

| Q. | Can I vote on other matters? |

| A. | We do not expect any other matter to come before the meeting. If any other matter is presented at the Special Meeting, the signed proxy gives the individuals named as proxies authority to vote the shares on such matters at their discretion. |

| Q. | Can I obtain an electronic copy of the proxy materials? |

| A. | Yes, this Proxy Statement, the accompanying Notice of Special Meeting of Stockholders and the proxy card are available on the Internet at www.astproxyportal.com/ast/FORUM. |

| Q. | What happens if the Special Meeting is adjourned or postponed? |

| A. | Although it is not expected, the Special Meeting may be adjourned or postponed for the purpose of soliciting additional proxies. Any adjournment or postponement may be made without notice, other than by an announcement made at the Special Meeting, by approval of the holders of a majority of the outstanding shares of our Common Stock present virtually, or represented by proxy at the Special Meeting, whether or not a quorum exists. Any signed proxies received by the Company will be voted in favor of an adjournment or postponement in these circumstances. Any adjournment or postponement of the Special Meeting for the purpose of soliciting additional proxies will allow Company stockholders who have already sent in their proxies to revoke them at any time prior to their use. |

| Q. | Who can help answer my other questions? |

| A. | If you have more questions about the Proposal or voting, you should contact John C. Ivascu, Executive Vice President, General Counsel, Chief Compliance Officer and Corporate Secretary, Forum Energy Technologies, Inc., 10344 Sam Houston Park Drive, Suite 300, Houston, Texas 77064, telephone number (713) 351‑7900. If your shares are held in an account at a broker, dealer, commercial bank, trust company or other nominee, you should also call such broker or other nominee for additional information. |

Any holderSEC Filings

If your properly executed proxy does not indicate how you wish to vote your common stock, the persons named on the proxy card will vote as follows:

Proposal 1: “FOR ALL”;

Proposal 2: “FOR”;

Proposal 3: “FOR”; and

Proposal 4: “FOR”.

COST AND METHOD OF PROXY SOLICITATION

We will bear the cost“Financial Information” subsection of the solicitation of proxies. In addition“Investors” section or the SEC’s website at www.sec.gov.

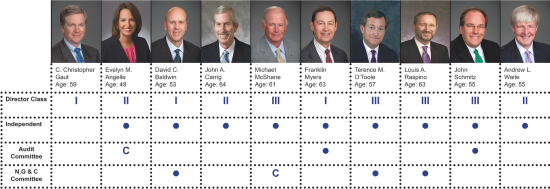

PROPOSAL 1: ELECTION OF DIRECTORS

The board of directors currently comprises ten members. The ten members are divided into three classes having three members in each of Class I and II and four members in Class III. Each class is elected for a term of three years, so that the term of one class of directors expires at each annual meeting of stockholders. The termspread of the three current Class I directors will expire atcoronavirus caused a significant decline in economic activity and oil demand. At the annual meeting.same time, the OPEC+ oil producing nations increased production in an effort to grow market share, which further exacerbated the imbalance between supply and demand. The termscombination of these shocks in both supply and demand caused a significant decline in oil prices during the Class II directors expire at the annual meetingfirst quarter 2020 and created an extremely challenging market for all sub‑sectors of stockholders to be held in 2017 and the terms of the Class III directors expire at the annual meeting of stockholders to be held in 2018.

Nominees for Election

The board of directors, upon the recommendation of the Nominating, Governance & Compensation Committee, or the “Committee”, has nominated for submission to the stockholders Messrs. Gaut, Baldwin and Myers as Class I directors for a term of three years, each to serve until the annual meeting of stockholders in 2019 or until his successor is elected and qualified. If any of the nominees becomes unavailable for any reason, which is not anticipated, the board of directors, in its discretion, may designate a substitute nominee. If you have filled out the accompanying proxy card, your vote will be cast for the substitute nominee. Our board of directors has determined that Messrs. Baldwin and Myers are “independent” as that term is defined by the applicable NYSE listing standards. Mr. Gaut is not independent given his position as our Chief Executive Officer.

Vote Required and Board Recommendation

If a quorum is present at the annual meeting, the three nominees receiving the greatest number of votes cast will be elected as directors. Your board of directors unanimously recommends a vote “FOR ALL” of the aforementioned three director nominees.

Our board of directors is divided into three classes of directors serving staggered three-year terms. Set forth below are the names of, and certain information with respect to, our directors, including the three nominees for election to the Class I positions on our board of directors, as of March 21, 2016.

Forum’s Board – At a Glance

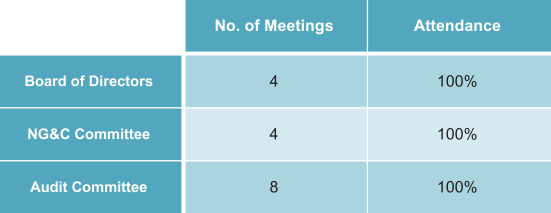

2015 Meeting Attendance

Board Nominees – Class I Directors

C. Christopher Gaut

Mr. Gaut has served as our President, Chief Executive Officer and Chairman of the board of directors since August 2010 and as one of our directors since December 2006. He served as a consultant to L.E. Simmons & Associates, Incorporated (“LESA”), the ultimate general partner of SCF-V, L.P., SCF 20212A, L.P., SCF-VI, L.P., SCF 2012B, L.P. and SCF-VII, L.P. (collectively, “SCF”), our largest stockholder, from November 2009 to August 2010. Mr. Gaut served at Halliburton Company, a leading diversified oilfield services company, as President of the Drilling and Evaluation Division and prior to that as Chief Financial Officer, from March 2003 through April 2009. From April 2009 through November 2009, Mr. Gaut was a private investor. Prior to joining Halliburton Company in 2003, Mr. Gaut was the Co-Chief Operating Officer of Ensco International, a provider of offshore contract drilling services. He also served as Ensco’s Chief Financial Officer from 1988 until 2003. Mr. Gaut is currently a member of the board of directors of Ensco plc, the successor to Ensco International. The board is nominating Mr. Gaut because he is our chief executive officer and, in addition, has experience in other executive leadership roles of energy companies, including as a senior operations and financial executive; expertise in the oil and gas business; knowledge of the demands and expectations of our customers; experience in building a successful oil service public company; and service as a board member of another public company.

David C. Baldwin

Mr. Baldwin was appointed as a director of Forum in May 2005. Mr. Baldwin is Co-President of LESA, and has been an officer of that company since 1991. Prior to joining LESA, Mr. Baldwin was a drilling and production engineer with Union Pacific Resources, an independent natural gas and oilindustry throughout the second quarter 2020. Due to the poor market conditions, exploration and production company. Mr. Baldwin serves ascompanies in North America are under pressure to reduce existing production and minimize capital and maintenance expenditures. As a directorresult, we have experienced a material reduction in demand for many of Rockwater Energy Solutions, Inc.,our products and consequently, our revenue. We expect this to have a private energy services company; Beckman Production Services, Inc., a private energy services company; Oil Patch, Inc., a private energy services company;significant negative impact on demand for our products and served as a directorresults of Complete Production Services, Inc., a provideroperations.

Franklin Myers

Mr. Myers was appointed as a director of Forum in September 2010 and the Lead Independent Director of the board of directors in December 2011. Mr. Myers serves as Senior Advisor to Quantum Energy Partners, a Houston-based private equity firm. Previously, Mr. Myers served as Senior Advisor to Cameron International Corporation, a publicly traded provider of flow equipment products, from April 2008 through March 2009, prior to which, from 2003 through March 2008, he served as the Senior Vice President and Chief Financial Officer. From 1995 to 2003, he served as Senior Vice President and President of a division within Cooper Cameron Corporation, as well as General Counsel and Secretary. Prior to joining Cooper Cameron Corporation in 1995, Mr. Myers served as Senior Vice President and General Counsel of Baker Hughes Incorporated, and as attorney and partner at the law firm of Fulbright & Jaworski (now known as Norton Rose Fulbright). Mr. Myers currently serves on the board of directors of ION Geophysical Corporation, a technology-focused seismic solutions company, Comfort Systems USA, Inc., a national heating, ventilation and cooling company, and HollyFrontier Corporation, a refining and marketing company. Mr. Myers also served as an operating adviser for Paine Partners, a private equity fund, from 2009 through December 2012. The board of directors is nominating

Mr. Myers because his extensive experience as both a financial and legal executive makes him uniquely qualified as a valuable member of our board of directors. Mr. Myers has been responsible for numerous successful finance and acquisition transactions throughout his career, and his expertise gained through those experiences has proven to be a significant resource for our board of directors. In addition, the board of directors in nominating Mr. Myers because his service on boards of directors of other NYSE-listed companies enables him to observe and advise on favorable governance practices pursued by other public companies.

Class II and Class III Board Members

Evelyn M. Angelle

Ms. Angelle was appointed as a director of Forum in February 2011 and currently serves as the Chairperson of the Audit Committee. From January 2014 through January 2015, Ms. Angelle served as Senior Vice President—Supply Chain for Halliburton, responsible for global procurement, materials, logistics and manufacturing. From January 2011 until December 2013, Ms. Angelle was Senior Vice President and Chief Accounting Officer for Halliburton, responsible for financial reporting, planning, budgeting, financial analysis and accounting services. From January 2008 until January 2011, Ms. Angelle was Vice President, Corporate Controller and Principal Accounting Officer for Halliburton. From December 2007 until January 2008, Ms. Angelle was Vice President of Operations Finance for Halliburton, leading finance employees located around the world. From April 2005 until November 2007, she also served as Vice President of Investor Relations, overseeing Halliburton’s communications and relationships with investors and analysts. Prior to that, she was responsible for internal and external reporting of consolidated financial statements, technical accounting research and consultation, and income tax accounting. Since January 2015, Ms. Angelle has been a private investor and philanthropist. Before joining Halliburton, Ms. Angelle worked for 15 years in the audit department of Ernst & Young LLP, where she specialized in serving large, multinational public companies and provided technical accounting and consultation to clients and other professionals. She is a certified public accountant in Texas and a certified management accountant. Ms. Angelle serves on the board of directors and on the executive committees of Junior Achievement of Southeast Texas and Junior Achievement USA.Old Notes. As a result of her professional experience, Ms. Angelle possesses particular knowledgethese factors and to promote our long‑term financial viability, on July 6, 2020 we commenced an exchange offer (the “Exchange Offer”) with holders of our Old Notes, to exchange their Old Notes for new 9.00% Convertible Senior Secured Notes due 2025 (the “New Notes”), to improve our capital structure by extending the upcoming maturities of our debt securities. The New Notes are convertible into our common stock (“Common Stock”) on a pro rata basis at a conversion price of $1.35 per share, subject, however, to the condition that the average of the daily trading prices for our Common Stock over the preceding 20‑trading day period is at least $1.50 per share. The conversion price of $1.35 per share represents a premium of 178.4% to the closing price on July 2, 2020, the last trading day prior to commencement of the Exchange Offer. The Exchange Offer was made in accounting, internal controlsconnection with our ongoing efforts to improve our capital structure by extending the upcoming maturities of our debt securities and public company disclosure compliance.creates alignment between the long term interests of both our stockholders and noteholders. On August 4, 2020, we successfully completed the Exchange Offer and exchanged $315,489,000 in aggregate principal amount of Old Notes for an equal principal amount of New Notes.

John A. Carrig

Mr. Carrig was appointed as a director of Forum in July 2011. He retired from ConocoPhillips on March 1, 2011, having most recently served as President and Chief Operating Officer since 2008, where he was responsible for global Exploration and Production, Refining and Marketing, Commercial, Project Development and Procurementthe

major public company with global reach, and his strategic, financial and management acumen. In addition, Mr. Carrig brings valuable insight as a result of his long history as a customer for oilfield equipment and services.

Michael McShane

Mr. McShane was appointed as a director of Forum in September 2010 and currently serves as the Chairpersonpart of the Nominating, Governance and Compensation Committee. Mr. McShane also currently serves as an Operating Partner to Advent International, an international private equity fund. Mr. McShane has been a director of Spectra Energy Corp., a provider of natural gas infrastructure, since April 2008; Complete Production Services, Inc., a provider of specialized oil and gas completion and production services, from March 2007 until February 2012; Superior Energy Services, Inc., a provider of specialized oilfield services and equipment, since the completion of Superior Energy’s acquisition of Complete Production Services in February 2012; and Oasis Petroleum Inc., an exploration and production company, since May 2010. Previously, Mr. McShane served as a director, and President and Chief Executive Officer of Grant Prideco, Inc., a manufacturer and supplier of oilfield drill pipe and other drill stem products, from June 2002 until April 2008, having also served as Chairmanproxy solicitation materials.

Terence M. O’Toole

Mr. O’Toole was appointed as a director of Forum and a memberrules of the Nominating, Governance & Compensation Committee in April 2012. Mr. O’Toole is the Co-Managing Partner of Tinicum Incorporated, the management company of each of Tinicum L.P., Tinicum Capital Partners II, L.P., and Tinicum Capital Partners II Add-On, L.P. (and each of their affiliated partnerships), together all such partnerships referred to herein as the “Tinicum Partnerships”. Prior to joining the Tinicum Partnerships in January 2006, Mr. O’Toole spent twenty-one years at Goldman, Sachs & Co., where he was a partner, a memberNYSE, of the investment committeeissuance of up to 145,052,272 shares of Common Stock upon conversion of the Applicable Percentage of the New Notes.

Louis A. Raspino

Mr. Raspino was elected as a director of Forum in January 2012. He currently serves as Chairman of Clarion Offshore Partners LLC, a position he has held since February 2016. Mr. Raspino was named President, Chief Executive Officer and a director of Pride International, Inc., a contract drilling company, in June 2005 and served in that capacity until its acquisition by Ensco plc in May 2011. Mr. Raspino was a private investor and consultant from June 2011 to January 2016. He joined Pride International in December 2003 as Executive Vice President and Chief Financial Officer. From July 2001 until December 2003, he served as Senior Vice President, Finance and Chief Financial Officer of Grant Prideco, Inc. From February 1999 until March 2001, he held various senior financial positions, including Vice President of Finance for Halliburton Company. From October 1997 until July 1998, he was a Senior Vice President at Burlington Resources, Inc. From 1978, until its merger with Burlington Resources, Inc. in 1997, he held a variety of positions of increasing responsibility at Louisiana Land and Exploration Company, most recently as Senior Vice President, Finance and Administration and Chief Financial Officer. Mr. Raspino’s significant experience as an executive officer of other energy companies, service as a member of other boards of directors, and his operational, strategic and financial expertise in the oil and gas business make him well qualified to serve on our board of directors.

John Schmitz

Mr. Schmitz was appointed as a director of Forum in September 2010. Mr. Schmitz currently serves as the Chairman and Chief Executive Officer of Select Energy Services, LLC, an oil and gas services company, a position he has held since January 2007. In addition to his Board service at Forum and Select Energy, Mr. Schmitz serves on the Boards of Silver Creek Oil & Gas, LLC (the surviving entity of the merger of Alta Natural Resources, LLC and HEP Oil Company, Ltd.), Nine Energy Service, Inc., CP Energy Holdings, LLC, and Synergy Energy Holdings, LLC, among others. Prior to his current involvement at Select Energy Services, LLC, Mr. Schmitz served as the North Texas Division Manager for Complete Production Services, Inc., a provider of specialized services and products focused on helping oil and gas companies develop hydrocarbon reserves, reduce costs and enhance production. Mr. Schmitz is also the President of Sunray Capital GP, LLC, a Texas limited liability company, the general partner of Sunray Capital, LP, and President of Schmitz & Schmitz Properties, Inc., a Texas limited partnership, the general partner of B-29 Investments, LP. Mr. Schmitz’ keen insightbe convertible into emerging trends in North American shale plays and the types of equipment needed to service producers’ requirements make him well qualified to serve on our board of directors. He also has knowledge of other manufacturers’ capabilities and their reputations for quality and deliverability, providing a valuable perspective on our evaluation of potential acquisitions.

Andrew L. Waite

Mr. Waite was appointed as a director in August 2010. Mr. Waite is Co-President of LESA and has been an officer of that company since 1995. He was previously Vice President of Simmons & Company International, where he served from August 1993 to September 1995. From 1984 to 1991, Mr. Waite held a number of engineeringshares of Common Stock that exceeds 1.0% of the number of shares of Common Stock or voting power outstanding before the issuance where those shares are issuable to a director, officer or “substantial security holder” of the Company or an affiliate of such person, (ii) the Common Stock issuable upon conversion of the New Notes to have upon issuance, voting power equal to or in excess of 20% of the voting power outstanding before the issuance of the New Notes, or (iii) the number of shares of Common Stock to be issued upon conversion of the New Notes to be equal to or in excess of 20% of the number of shares of Common Stock outstanding before the issuance of the New Notes.

Directors

Name and Address | Number of Shares Beneficially Owned (1) | Percent of Class | ||||||

Stockholders owning 5% or more: | ||||||||

SCF-V, L.P. and Related Entities | 24,257,800 | 26.6 | ||||||

Directors and Nominees: | ||||||||

C. Christopher Gaut (3) | 3,637,951 | 3.9 | ||||||

Evelyn M. Angelle | 82,755 | * | ||||||

David C. Baldwin(2)(4) | 24,292,221 | 26.6 | ||||||

John A. Carrig (5) | 76,883 | * | ||||||

Michael McShane | 95,412 | * | ||||||

Franklin Myers | 99,628 | * | ||||||

Terence M. O’Toole(6) | 2,987,774 | 3.3 | ||||||

Louis A. Raspino | 91,148 | * | ||||||

John Schmitz(7) | 2,183,822 | 2.4 | ||||||

Andrew L. Waite(2)(8) | 24,278,908 | 26.6 | ||||||

Other Named Executive Officers: | ||||||||

Prady Iyyanki | 122,589 | * | ||||||

James W. Harris | 623,453 | * | ||||||

James L. McCulloch | 525,751 | * | ||||||

Pablo Mercado | 129,239 | * | ||||||

All current executive officers and directors as a group (14 persons) | 35,062,816 | 38.4 | ||||||

Name and Address (1) | Number of Shares Beneficially Owned (2) | Percent of Class |

| Stockholders owning 5% or more: | ||

SCF-V, L.P. and Related Entities 600 Travis Street, Suite 6600 Houston, TX 77002 (3) | 17,780,755 | 16.0% |

Dimensional Fund Advisers, LP Building One 6300 Bee Cave Road Austin, TX 78746 (5) | 5,651,740 | 5.1% |

| Directors and Nominees: | ||

C. Christopher Gaut (6) | 4,558,657 | 4.1% |

Evelyn M. Angelle (7) | 226,296 | * |

David C. Baldwin (3)(8) | 18,436,905 | 16.6% |

John A. Carrig (9) | 142,299 | * |

| Michael McShane | 147,515 | * |

| Louis A. Raspino | 144,796 | * |

John Schmitz (10) | 2,626,550 | 2.4% |

Andrew L. Waite (3)(11) | 18,436,905 | 16.6% |

| Other Named Executive Officers: | ||

Pablo G. Mercado (12) | 85,028 | * |

| John C. Ivascu | 351,756 | * |

| D. Lyle Williams | 404,713 | * |

| Michael D. Danford | 420,144 | * |

| All executive officers and directors as a group (12 persons) | 28,200,808 | 25.3% |

| (1) | Unless otherwise indicated, the address of each beneficial owner is c/o Forum Energy Technologies, Inc., 10344 Sam Houston Park Drive, Suite 300, Houston Texas 77064. |

| (2) | The number of shares beneficially owned by the directors, director nominees and executive officers listed in the table includes shares that may be acquired within 60 days of |

| (3) | The number of shares reported is as of December 31, 2019 and is based on a Schedule 13G/A filed with the U.S. Securities and Exchange Commission (the "SEC") on February 12, 2020. SCF-V, L.P. is the direct owner of |

| (4) | The number of shares reported is as of December 31, 2019 and is based on a Schedule 13G/A filed with the |

| (5) | The number of shares reported is as of December 31, 2019 and is based on a Schedule 13G filed with the SEC on February 12, 2020 by Dimensional Fund Advisors LP. The Schedule 13G reports sole voting power for 5,368,153 shares of Common Stock, no shared voting power for shares of Common Stock, sole dispositive power for 5,651,740 shares of Common Stock and no shared dispositive power for shares of Common Stock. |

| (6) | Includes |

| (7) | Includes 18,000 shares of Common Stock beneficially owned by Ms. Angelle’s spouse. |

| (8) | Mr. Baldwin is the direct owner of |

| (9) | Includes 18,000 shares held in trust for the benefit of Mr. Carrig’s children. Mr. Carrig serves as trustee of the trust and disclaims beneficial ownership of the shares held by the trust. |

|

Mr. Schmitz is the direct owner of |

| (11) | Mr. Waite is the direct owner of 656,150 shares of Common Stock that were issued to him in connection with his service on our Board or otherwise purchased in the open market. Mr. Waite serves as |

|

|

|

Generally

Our non-employee director compensation program consists of an annual cash retainer and a value-based equity grant for all non-employee directors. We believe the cash retainer and annual equity awards provide us with an essential and valuable tool to ensure that the board can recruit talented directors to serve on the board and ensure that such directors’ interests are aligned with our stockholders. The Committee periodically commissions Pearl Meyer & Partners (“Pearl Meyer”), its independent compensation consultant, to conduct a market-based director compensation study.In December 2014 and December 2015, the study prepared by Pearl Meyer indicated that total compensation for our directors was and continues to be positioned below the compensation peer group median. It was Pearl Meyer’s recommendation that the value-based equity grant be increased for each director to bring total compensation into alignment with the median. The Committee determined not to increase non-employee director compensation in light of market conditions.

Directors’ fees

All non-employee directors received an annual base cash retainer of $70,000. C. Christopher Gaut does not receive an annual retainer or any other form of compensation for his service on the board of directors. The Chairperson of the Audit Committee received an additional annual retainer of $20,000, and the other members of that committee received an additional annual retainer of $10,000, in each case prorated as applicable. The Chairperson of the Nominating, Governance & Compensation Committee received an additional annual retainer of $15,000, and the other members of that committee received an additional annual retainer of $7,500, in each case prorated as applicable. The Lead Independent Director received an additional retainer of $20,000. We have not paid board of directors meeting fees or committee meeting fees to our directors.

Director equity-based compensation

Each non-employee director receives equity-based compensation in the form of restricted stock or restricted stock units. The form of award to a director is at the election of that director. Awards of restricted stock and restricted stock units for 2015 are more fully described in the table below. For the 2015 annual award made in February 2015, the award totaled an amount equal to $125,000 (rounded up to the nearest whole share), calculated based on the stock price at the close of trading on the relevant grant date. The 2015 annual awards vested twelve months from the date of grant. A director may elect to defer settlement of restricted stock units, in which case such settlement will occur upon termination of service in a cash lump sum or in annual installments over a period no longer than 10 years.

The following table provides information on Forum’s compensation for non-employee directors in 2015:

| Director Compensation for the year ended December 31, 2015 | ||||||||||||

| Name | Fees Earned in Cash ($) | Stock Awards (1) ($) | Total ($) | |||||||||

Evelyn M. Angelle | 90,000 | 125,007 | 215,007 | |||||||||

David C. Baldwin | 70,000 | 125,007 | 195,007 | |||||||||

John A. Carrig | 77,500 | 125,007 | 202,507 | |||||||||

Michael McShane | 85,000 | 125,007 | 210,007 | |||||||||

Franklin Myers | 100,000 | 125,007 | 225,007 | |||||||||

Terence M. O’Toole | 77,500 | 125,007 | 202,507 | |||||||||

John Schmitz | 80,000 | 125,007 | 205,007 | |||||||||

Louis A. Raspino | 77,500 | 125,007 | 202,507 | |||||||||

Andrew L. Waite | 70,000 | 125,007 | 195,007 | |||||||||

|

As of December 31, 2015, the total number of shares of common stock subject to outstanding stock option awards, and restricted stock or restricted stock unit awards held by each director is as follows:

| Name | Option Awards | Restricted Stock Units/Restricted Stock (1) | ||||||

Evelyn M. Angelle | 12,617 | 19,626 | ||||||

David C. Baldwin | — | 6,692 | ||||||

John A. Carrig | 6,549 | 19,626 | ||||||

Michael McShane | 28,786 | 6,692 | ||||||

Franklin Myers | 1,628 | 6,692 | ||||||

Terence M. O’Toole | — | 6,692 | ||||||

John Schmitz | 1,628 | 6,692 | ||||||

Louis A. Raspino | 6,179 | 6,692 | ||||||

Andrew L. Waite | — | 15,133 | ||||||

|

Director deferred compensation

Non-employee directors are eligible to participate in our deferred compensation plan. The plan provides that a director may defer all or any portion of his or her cash retainer paid for services as a director. All deferred cash amounts are credited with earnings through the date paid based on one or more benchmark rates selected by the Committee with a minimum return rate equal to the prime rate as published in the Wall Street Journal plus one percentage point. Upon a “change of control” within the meaning of Internal Revenue Code Section 409A, all account balances will be fully vested. The definition of a change of control event is the same as the definition under the 2010 Plan.

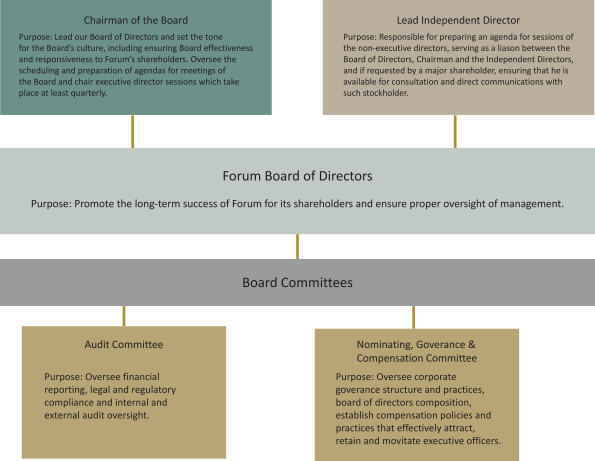

Board of Directors. The board of directors is responsible for oversight of our business and affairs. To assist it in carrying out its duties, the board of directors has delegated certain authority to our Audit Committee and Nominating, Governance & Compensation Committee. The board of directors also delegated, and may in the future delegate, certain authority to other committees of the board of directors from time to time. During 2015, the board of directors held four meetings. Each current director attended at least 75% of the total number of meetings of the board of directors and committees of the board of directors on which he or she served that were held during his or her term of service. Directors are expected to attend meetings of the board of directors and meetings of committees on which they serve, and to spend as much time and meet as frequently as necessary to properly discharge their responsibilities. In addition, directors are encouraged to attend annual meetings of our stockholders. All of our directors attended the annual meeting of stockholders in 2015. The board of directors has established a culture that results in the arrival at decisions through meaningful and fulsome discussion, where all views are considered and readily challenged. The directors hold management to the highest standards and challenge them to ensure the maximization of shareholder value.

The chart below explains the purpose of each level of hierarchy in our board of director’s leadership structure. More detail with regard to the composition, meetings and activities of each of the committees can be found below under “—Board Committees”.

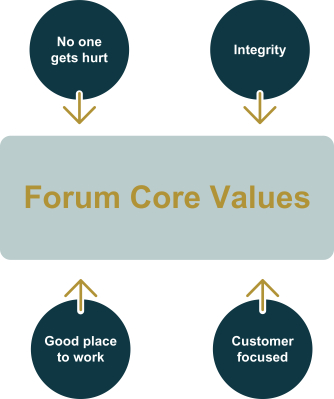

Code of Conduct. Our board of directors has adopted a Code of Conduct, which describes the responsibility of our employees, officers, directors and agents to:

protect our assets and customer assets;

foster a safe and healthy work environment;

deal fairly with customers and other third parties;

conduct international business properly;

report misconduct; and

protect employees from retaliation.

Employees, officers and directors are required to certify annually that they have read, understand and will comply with the Code of Conduct. The Code of Conduct is available on our website atwww.f-e-t.com under “Corporate Governance” in the “Investors” section.

Stock Ownership Requirements. To further align the interests of the directors with the long-term interests of stockholders, our board of directors has adopted a Stock Ownership Requirements Policy that requires non-employee directors to own shares equal to five times the annual base cash retainer in effect as of January 1 of each year. Directors are expected to reach this level of target ownership within five years of joining our board of directors in an individual capacity (other than pursuant to an agreement with a stockholder of the Company) or February 21, 2018, whichever is later. Actual shares of stock, restricted stock, restricted stock units (including deferred stock units) and earned but unvested performance shares may be counted in satisfying the stock ownership guidelines. Each of our directors meets the requirements set forth in the policy. In addition, as described more fully in the Compensation Discussion & Analysis section under “Other practices, policies and guidelines,” our named executive officers are required to own specified amounts of our stock, set at a multiple of each such officer’s base annual salary. Each of our named executive officers satisfies the stock ownership requirements set forth in the policy.Given the very significant amount of shares required to be held, we believe the policy is effective in aligning the interests of our directors and executive officers with those of our stockholders without imposing a minimum holding period or other requirement after vesting.

Corporate Governance Guidelines. The board of directors is committed to sound principles of corporate governance and has established Corporate Governance Guidelines that it believes are consistent with our values, and that assist the board in effectively exercising its responsibilities. The guidelines provide a framework for our company’s governance and the board’s activities, covering such matters as determining director independence, director orientation and continuing education, director responsibilities, director access to independent advisers and management, annual evaluations of the board and other corporate governance practices and principles. Our board periodically, and at least annually, reviews and revises, as appropriate, the guidelines to ensure they reflect the Board’s corporate governance objectives and commitments. The guidelines are available on our website atwww.f-e-t.com under “Corporate Governance” in the “Investors” section.

|

|

Director Independence. Our Corporate Governance Guidelines provide that a majority of the members of the board of directors and all of the members of the Audit Committee and the Nominating, Governance & Compensation Committee qualify as “independent directors” in accordance with the NYSE listing standards. In addition, it is the policy of the board of directors that all the members of the Audit Committee also satisfy the criteria for independence under applicable provisions of the U.S. Securities Exchange Act of 1934 (the “Exchange Act”) and applicable SEC rules. No director is considered independent unless the board of directors affirmatively determines that he or she has no material relationship with us, either directly or as a partner, stockholder or officer of an organization that has a relationship with us. The NYSE listing standards include objective tests that can disqualify a director from being treated as independent, as well as a subjective element, under which the board of directors must affirmatively determine that each independent director has no material relationship with us, either directly or as a partner, stockholder or officer of an organization that has a relationship with us. The board of directors considers all relevant facts and circumstances in making independence determinations.

Our board of directors has determined that all nine of our current non-management directors (Ms. Angelle and Messrs. Baldwin, Carrig, McShane, Myers, O’Toole, Raspino, Schmitz and Waite) qualify as “independent directors” in accordance with the listing standards of the NYSE and that each member of the Audit Committee and the Nominating, Governance & Compensation Committee qualifies as “independent” under the Exchange Act and applicable SEC rules. Mr. Gaut does not qualify as independent given his position as our Chief Executive Officer.

In making its subjective determination that each such director is independent, the board of directors reviewed and discussed information provided by the directors and us with regard to each director’s business and personal activities as they may relate to our company and management. The board of directors considered the transactions in the context of the NYSE’s objective listing standards, our Corporate Governance Guidelines, the additional standards established for members of audit committees and the SEC and U.S. Internal Revenue Service standards for compensation committee members.

In connection with its determination as to the independence of Messrs. Baldwin and Waite, our board of directors considered the relationships between Forum and SCF and its affiliates, our largest stockholder. In addition, in connection with its determination as to the independence of Messrs. O’Toole and Schmitz, our board of directors considered the relationships between us and each of Tinicum and companies affiliated with Mr. Schmitz. For a description of the agreements and transactions between us and each of SCF and its affiliates, Tinicum and its affiliates, and Mr. Schmitz and his affiliates, please see “Conflicts of Interest and Related Person Transactions.” Our board of directors believes that these transactions and relationships do not adversely affect Messrs. Baldwin’s, O’Toole’s, Schmitz’s or Waite’s ability or willingness to act in the best interests of Forum and its stockholders or otherwise compromise each such director’s independence. None of our directors serves as a director, executive officer or employee of a non-profit organization to which we made payments or contributions in excess of $25,000 over the last three fiscal years.

Separation of Chairman and CEO Roles. Our bylaws give the board of directors the flexibility to determine whether the roles of Chairman and Chief Executive Officer should be combined or separate. Our board of directors has chosen to combine the roles of Chief Executive Officer and Chairman of the Board, both of which are held by Mr. Gaut. The board of directors believes that having Mr. Gaut fill both roles remains the best leadership structure for us at this time. During periods in which the offices of Chairman and Chief Executive

Officer are combined, our Corporate Governance Guidelines provide that there shall be a Lead Independent Director. Mr. Myers is our Lead Independent Director. As Lead Independent Director, he presides over the executive sessions of the independent and non-management directors.

Executive Sessions. The non-management directors meet regularly in executive session without management participation after regularly scheduled board meetings. In addition, our Corporate Governance Guidelines provide that, if the group of non-management directors includes a director who is not independent under NYSE listing standards, the independent directors will meet in executive session at least once annually. Currently, the director who presides at these meetings is the Lead Independent Director. Our Corporate Governance Guidelines provide that, if the Lead Independent Director ceases to be independent, then the presiding director will be chosen by a vote of the non-management directors or independent directors, as the case may be.

Board’s Role in Risk Oversight. Our board of directors is actively involved in oversight of risks that could affect us. This oversight function is conducted primarily through committees of our board of directors, but the full board of directors retains responsibility for general oversight of risks. The Audit Committee is charged with oversight of our system of internal controls and risks relating to financial reporting, legal, regulatory and accounting compliance. Our board of directors satisfies its oversight responsibility through full reports from the Audit Committee chairperson regarding the committee’s considerations and actions, as well as through regular reports directly from officers responsible for oversight of particular risks. Management has implemented an enterprise risk management process which is reviewed on a periodic basis by the Audit Committee to ensure consistency of risk considerations in making business decisions. In addition, we have internal audit systems in place to review adherence to policies and procedures, which are supported by a separate internal audit department. The Nominating, Governance & Compensation Committee also oversees risks related to our compensation programs, management retention and development, the composition and leadership structure of the board of directors, and corporate governance risks. Regular assessments of risk are a priority for us.

Accounting and Auditing Concerns. The Audit Committee has established procedures to receive, retain and treat complaints regarding accounting, internal accounting controls or auditing matters and to allow for the confidential and anonymous submission by employees of concerns regarding questionable accounting or auditing matters.

Communication with the Board. Stockholders and other interested parties may make their concerns known confidentially to the board of directors or the non-management directors by submitting a communication in an envelope addressed to the “Board of Directors,” a specifically named non-management director or the “Non-Management Directors” as a group, in care of the Secretary. All such communications will be conveyed, as applicable, to the full board of directors, the specified non-management director or the non-management directors as a group.

Organization of the Committees of the Board of Directors

Nominating, Governance & Compensation Committee. The Nominating, Governance & Compensation Committee currently consists of Michael McShane (Chairperson), John A. Carrig, Terence M. O’Toole and Louis A. Raspino. Each of the committee members is a “non-employee director” as defined under Rule 16b-3 of the Exchange Act and an “outside director” as defined in section 162(m) of the Internal Revenue Code of 1986. The purposes of the Nominating, Governance & Compensation Committee are, among others, to:

Advise the board of directors and make recommendations regarding appropriate corporate governance practices, and assist the board of directors in implementing those practices;

Assist the board of directors by identifying individuals qualified to become members of the board of directors, and recommending director nominees to the board of directors;

Advise the board of directors about the appropriate composition of the board of directors and its committees;

Review, evaluate and approve our agreements, plans, policies and programs to compensate our corporate officers and directors;

Review and discuss with our management the compensation discussion and analysis included in this proxy statement and to determine whether to recommend to the board of directors that compensation discussion and analysis be included in this proxy statement, in accordance with applicable rules and regulations; and

Perform such other functions as the board of directors may assign to the committee from time to time.

The committee held four meetings during 2015. The board of directors has adopted a written charter for the Nominating, Governance & Compensation Committee, which is available on our website atwww.f-e-t.com as described above.

Although the board of directors does not have a formal diversity policy, the Nominating, Governance & Compensation Committee, when assessing the qualifications of prospective nominees to the board of directors, considers diversity in its broadest sense, including persons diverse in perspectives, personal and professional experiences, geography, gender, race and ethnicity. This process has resulted in a board of directors that is comprised of highly qualified directors that reflect diversity as we define it.

Each nominee’s personal and professional integrity, experience, skills, ability and willingness to devote the time and effort necessary to be an effective board member, and commitment to acting in the best interests of our company and our stockholders, are also factors. The board of directors does not select director nominees on the basis of race, color, gender, national origin, citizenship, marital status or religious affiliation.

The Nominating, Governance & Compensation Committee will consider director candidates recommended by stockholders. If a stockholder wishes to recommend a director for nomination by the committee, the stockholder should submit the recommendation in writing to the Chairperson, Nominating, Governance & Compensation Committee, in care of the Secretary, Forum Energy Technologies, Inc., 920 Memorial City Way, Suite 1000, Houston, Texas 77024. The recommendation should contain the following information:

The name, age, business address and residence address of the nominee and the name and address of the stockholder making the nomination;

The principal occupation or employment of the nominee;

The number of shares of each class or series of our capital stock beneficially owned by the nominee and the stockholder and the period for which those shares have been owned; and

Any other information the stockholder may deem relevant to the committee’s evaluation.

Candidates recommended by stockholders are evaluated on the same basis as candidates recommended by our directors, executive officers, third-party search firms or other sources.

Audit Committee. The Audit Committee currently consists of Ms. Evelyn M. Angelle (Chairperson) and Messrs. Franklin Myers and John Schmitz. The board of directors has determined that Ms. Angelle and Mr. Myers each is an “audit committee financial expert” as defined by applicable SEC rules. The committee’s purposes are to assist the board of directors with overseeing:

The integrity of our financial statements;

Our compliance with legal and regulatory requirements;

The qualifications, independence and performance of our independent auditors; and

The effectiveness and performance of our internal audit function.

The committee held eight meetings during 2015. The board of directors has adopted a written charter for the Audit Committee, which is available on our website atwww.f-e-t.com as described above.

Compensation Committee Interlocks and Insider Participation. During the fiscal year ended December 31, 2015, none of our executive officers served as (1) a member of the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served on our Nominating, Governance & Compensation Committee, (2) a director of another entity, one of whose executive officers served on our Nominating, Governance & Compensation Committee or (3) a member of the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served as one of our directors. In addition, none of the members of our Nominating, Governance & Compensation Committee (1) was an officer or employee of Forum during 2015, (2) was formerly an officer of the Company, or (3) had any relationship requiring disclosure under any paragraph of Item 404 of Regulation S-K.

CONFLICTS OF INTEREST AND RELATED PERSON TRANSACTIONS

Procedures for approval of related person transactions

A “related person transaction” is a transaction, arrangement or relationship in which we or any of our subsidiaries was, is or will be a participant, the amount of which involved exceeds $120,000, and in which any related person had, has or will have a direct or indirect material interest. A “related person” means:

any person who is, or at any time during the applicable period was, one of our executive officers or one of our directors;

any person who is known by us to be the beneficial owner of more than 5% of our common stock;

any immediate family member of any of the foregoing persons, which means any child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law or sister-in-law of a director, executive officer or a beneficial owner of more than 5% of our common stock and any person (other than a tenant or employee) sharing the household of such director, executive officer or beneficial owner of more than 5% of our common stock; and

any firm, corporation or other entity in which any of the foregoing persons is a partner or principal or in a similar position or in which such person has a 10% or greater beneficial ownership interest.

Our board of directors has adopted a written related person transactions policy, pursuant to which the Audit Committee reviews all material facts of all related party transactions and either approves or disapproves entry into the transaction, subject to certain limited exceptions. In determining whether to approve or disapprove entry into a related party transaction, the Audit Committee takes into account, among other factors, the following: (1) whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third-party under the same or similar circumstances, (2) the extent of the related person’s interest in the transaction and (3) whether the transaction is material to us.

SCF Registration Rights Agreement

Demand Registration Rights. Under the Registration Rights Agreement dated August 2, 2010 we entered into with SCF (the “Registration Rights Agreement”), SCF currently has the right to demand on four occasions that we register with the SEC all or any portion of SCF’s Registrable Securities (as such term is defined in the Registration Rights Agreement) so long as the Registrable Securities proposed to be sold on an individual registration statement have an aggregate gross offering price of at least $20 million (or at least $10 million if we are then eligible to register such sale on a Form S-3 registration statement (or any comparable or successor form) (a “Demand Registration”). Holders of SCF’s Registrable Securities may not require us to effect more than one Demand Registration in any six-month period. Any demand request by SCF with a reasonably anticipated aggregate offering price of $100 million may be for a “shelf” registration statement pursuant to Rule 415 under the U.S. Securities Act of 1933 (the “Securities Act”); provided that any such “shelf” registration statement demand request will count as two demand requests.

Piggyback Registration Rights. If we propose to file a registration statement under the Securities Act, relating to an offering of our common stock (other than a registration statement filed relating to securities offered in connection with benefit plans or acquisitions or any registration statement filed in connection with an exchange offer or offering solely to our stockholders), holders of Registrable Securities can request that we include in such registration, and any related underwriting, all or a portion of their Registrable Securities.

Holdback Agreements. Each holder of Registrable Securities is subject to certain lock-up provisions that restrict transfer during the period beginning 14 days prior to, and continuing for a period not to exceed 90 days for any underwritten public offering of our equity securities, except as part of such registration (subject to an extension of such lock-up period in certain circumstances).

Registration Procedures and Expenses. The Registration Rights Agreement contains customary procedures relating to underwritten offerings and the filing of registration statements. We have agreed to pay all registration expenses incurred in connection with any registration. All underwriting discounts and selling commissions and stock transfer taxes applicable to securities registered by holders and fees of counsel to any such holder (other than as described above) will be payable by holders of Registrable Securities.

Indemnification and Contribution. The Registration Rights Agreement also contains customary indemnification and contribution provisions by us for the benefit of holders participating in any registration. Each holder participating in any registration agrees to indemnify us in respect of information provided by such holder to us for use in connection with such registration; provided that such indemnification will be limited to the net proceeds actually received by such indemnifying holder from the sale of Registrable Securities.

Tinicum Registration Rights Agreement

Concurrently with our initial public offering, we issued 2,666,666 shares of our common stock at the public offering price less the underwriting discount in a private placement to Tinicum. In connection with the private placement, Tinicum obtained piggyback registration rights on the same terms described above with respect to SCF.

Transactions with our significant stockholders, directors and officers

During 2015, a subsidiary of Forum sold certain products and equipment to IPS Canada and Nine Energy Service, Inc., and Forum recognized revenue in an amount totaling approximately $0.5 million and $7.3 million, respectively. Each of these companies are portfolio companies of SCF, and Messrs. David C. Baldwin and Andrew L. Waite are Co-President of LESA, the ultimate general partner of SCF. In addition, a subsidiary of Forum sold or rented certain products and equipment to Nautronix and Forum recognized revenue in an amount totaling approximately $0.3 million. Nautronix was a portfolio company of SCF until September 5, 2015. These sales and rentals were made based on arms-length terms between the parties and represent less than 1% of the consolidated gross revenues for 2015 for Forum, and less than approximately 3% and 3% of the consolidated gross revenues for 2015 for IPS Canada and Nine Energy Service, and approximately 1% of the consolidated gross revenues of Nautronix for the nine months ended September 30, 2015.

Also during 2015, a subsidiary of Forum purchased products from and sold equipment to Bell Supply in an amount totaling in the aggregate approximately $2.1 million. Mr. Schmitz is the Chairman of the board of managers of Synergy Energy Holdings, LLC, Bell Supply’s parent. These purchases were made on arms-length terms between the parties and represent less than 1% and 2% of the consolidated gross revenues for 2015 for Forum and Bell Supply, respectively. We also had sales of equipment for an aggregate amount of $1.4 million during 2015 to Silver Creek Oil and Gas. Silver Creek Oil & Gas is an affiliate of B-29 Investments, L.P. Mr. Schmitz is the Chairman and Chief Executive Officer of the ultimate parent of B-29 Investments, LP. These sales were made on arms-length terms between the parties and represent less than 1% and 2% of the consolidated gross revenues for 2015 for Forum and Silver Creek Oil & Gas, respectively.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our executive officers and directors and beneficial owners of more than ten percent of any class of equity securities to file initial reports of ownership and reports of changes in ownership of our common stock with the SEC and, pursuant to rules promulgated under Section 16(a), such individuals are required to furnish us with copies of Section 16(a) reports they file. Based solely on a review of the copies of such reports furnished to us during the year ended December 31, 2015 and written representations from our officers and directors, all Section 16(a) reports applicable to our officers and directors and any beneficial owners of ten percent or more of a class of equity securities were filed on a timely basis except for one late Form 4 filing by Prady Iyyanki, Executive Vice President and Chief Operating Officer, with respect to the payment of a tax liability associated with the vesting of a restricted stock award by delivering to us 3,186 shares.

PROPOSAL 2: ADVISORY RESOLUTION TO APPROVE EXECUTIVE COMPENSATION

|

|

|

In accordance with Section 14A of the Exchange Act and the related rules of the SEC, we are providing our stockholders with the opportunity to approve, on a non-binding, advisory basis, the compensation of our named executive officers. This item, commonly referred to as a “say-on-pay” vote, provides you, as a stockholder, the opportunity to express your views regarding the compensation of our named executive officers as disclosed in this proxy statement.

Our executive compensation program is designed to attract, motivate and retain our named executive officers, who are critical to our success. Under our program, our named executive officers are rewarded for strong corporate performance, the achievement of specific annual goals and the realization of increased stockholder value. Please read “Compensation Discussion and Analysis” and “Executive Compensation” for additional details about our executive compensation programs, including information about the fiscal year 2015 compensation of our named executive officers.

The Nominating, Governance & Compensation Committee continually reviews the compensation program for our named executive officers to ensure the program achieves the desired goals of aligning our executive compensation structure with our stockholders’ interests and current market practices. We believe our executive compensation program achieves the following objectives:

Motivate our executives to achieve key operating, safety and financial performance goals that enhance long-term stockholder value;

Reward outstanding performance in achieving these goals without subjecting us to excessive or unnecessary risk; and

Establish and maintain a competitive executive compensation program that enables us to attract, motivate and retain experienced and highly capable executives who will contribute to our long-term success.

We are asking our stockholders to indicate their support for our named executive officers’ compensation as described in this proxy statement and ask that our stockholders approve the following non-binding resolution at the annual meeting:

“RESOLVED, that the stockholders of Forum Energy Technologies, Inc. (the “Company”) approve, on a non-binding, advisory basis, the compensation of the Company’s named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the compensation tables and the other narrative discussion in the proxy statement for the 2016 Annual Meeting of Stockholders of the Company.”